When it comes to keeping your business running strong, there’s nothing more important than the safety of your employees. That’s why it’s so crucial for employers to set aside the time and energy to develop meaningful guidelines around mobile phone use for employees who spend a lot of time behind the wheel. According to the National Highway Traffic Safety Administration (NHTSA), distracted driving, including cell phone use. caused approximately 3,300 deaths and over 290,000 injuries nationwide in 2022. This highlights just how much of a risk distracted driving can be for everyone on the road.

The workers’ compensation industry has also seen an increase in claims involving motor vehicle accidents, so developing a cell phone policy may also help to reduce collision-related injuries. But it’s not about liability, it’s about protecting your workers. Ensuring their safety and security is an essential part of running a business, even if that means laying out some clear rules about cell phone use.

The fact is, these convenient, yet distracting, gadgets have become a normal part of most working environments and it’s unlikely that will change. But that doesn’t mean you can’t find a healthy solution, or redraw the lines between work and play.

If you’re looking to implement a workplace cell phone policy, consider these 3 helpful steps:

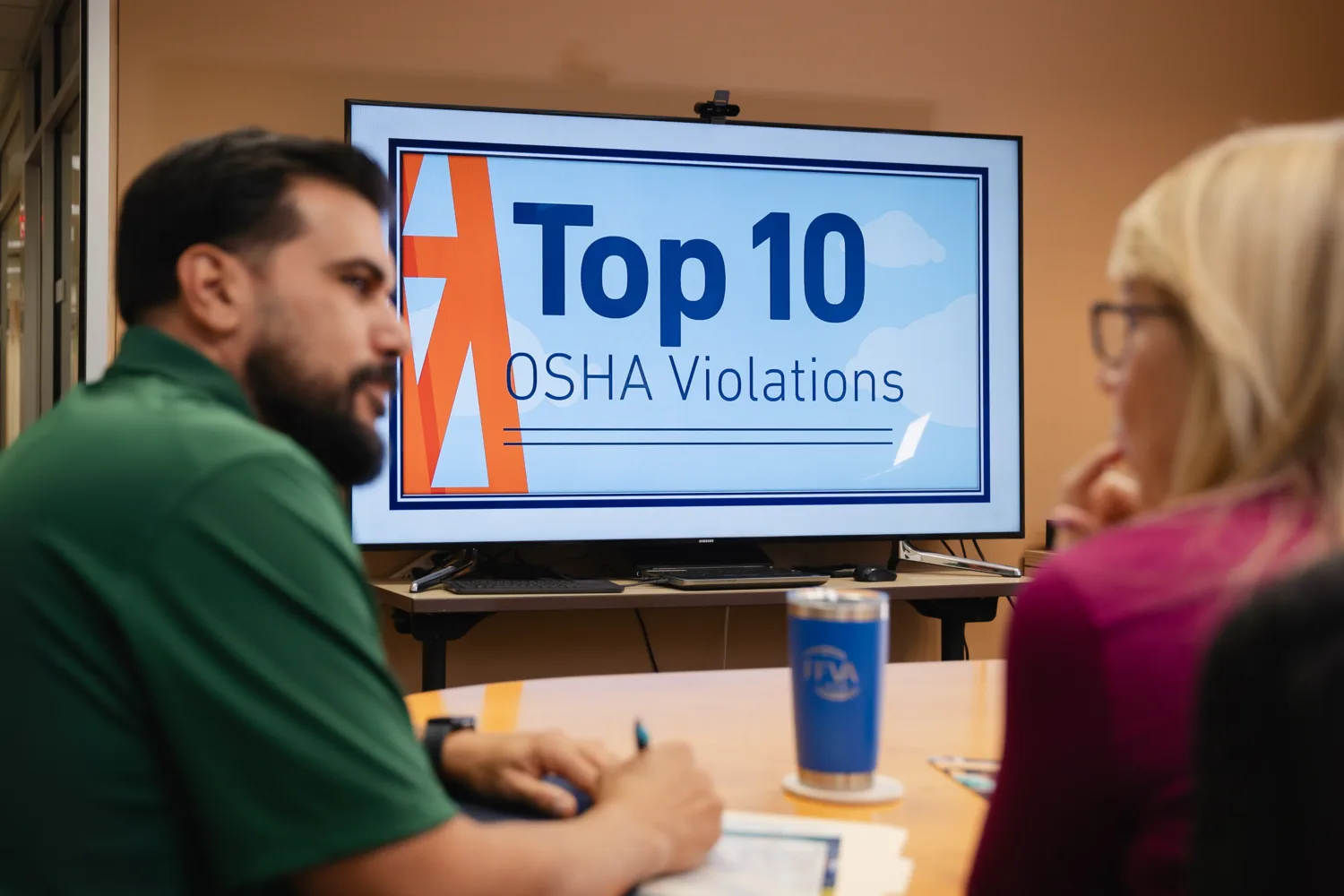

1. Educate

The first step to developing an effective workplace cell phone policy is to educate your workers on what exactly distracted driving is. While it’s important to accurately explain the risks, it’s even more important for your employees to understand how cell phone use impairs their ability to operate a motor vehicle. The Center for Disease Control (CDC) categorizes driving distractions into three main types:

- Visual: Anything that takes a driver’s eyes off the road is considered a visual distraction, such as reading text messages, checking caller ID and looking up directions.

- Manual: Anything that takes a driver’s hands off the wheel is considered a manual distraction, such as texting-and-driving, answering a phone call and scrolling through a music playlist.

- Cognitive: Anything that takes a driver’s mind off of driving is considered a cognitive distraction, such as talking on the phone, planning out the day or thinking about upcoming appointments.

The most dangerous forms of distracted driving combine all these types, which is why texting-and-driving is such a major roadway hazard. A study by the Occupational Safety and Health Administration (OSHA) found that drivers who send or receive texts shift their attention away from the road for an average of 4.6 seconds. This is the same as driving the length of a football field blindfolded at 55 mph. To ensure your employees are giving their full attention to the road, you may need to designate all company vehicles (and personal vehicles during working hours) as “text-free zones.” If you’re looking for more in-depth information, check out the NSC’s free Safe Driving Toolkit.

2. Clarify

To create a successful cell phone policy, use clear and concise language in the guidelines. Always avoid vague wording whenever possible, as it will introduce unwanted “wiggle-room” and may cause confusion about the rules. For example, avoiding texting while driving seems like an easy rule to understand, but many mobile devices have hands-free features that allow users to dictate messages verbally. While this may sound less dangerous than texting by hand, drivers still need to take their eyes off the road to check for errors and read replies. If your goal is to reduce distracted driving in all its forms, you should always be on the lookout for ways your policies might be stretched without (necessarily) being broken.

Sometimes, your employees may need to use a cell phone to communicate with managers, customers or coworkers as part of their jobs. Just be sure they aren’t risking their safety to do so. Establishing clear procedures about when and where your employees can stop to text or talk on their mobile phones is crucial when on the road, as it focuses the policies on solutions rather than penalties.

3. Encourage

The truth is that workplace cell phone policies are never 100% enforceable. Technology changes, employees come and go, yet risks to your staff’s health and safety will always exist in some form or another. When it comes to distracted driving, it’s important to demonstrate that your employees’ safety is the motivating force behind your policies. Taking the time to explain (face-to-face if necessary) what your staff needs to do to comply with your company’s policies is a great way to build credibility and trust. But as much as you may want to leave it at that, managers still need to lay out what actions will be taken if the safety guidelines are broken.

Accident prevention starts with mutual understanding. To ensure everyone is on the same page, it’s useful to put cell phone policies in print and ask your employees to sign them. Managers should also consider incorporating the policy into new worker orientation and training to set expectations right from the start. Remember, safe workplace policies aren’t just a way to reduce liability, they’re a gateway to peace of mind – for your business, for your employees, and for the people that depend on both to live a healthy and happy life.

To help your employees stay safe on the job, check out some of our other safety resources.